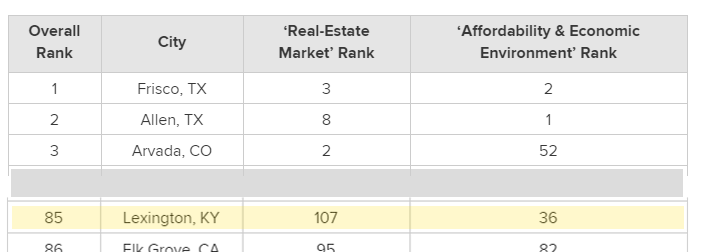

Lexington, KY ranks 85 of 300 Healthy Real Estate Markets!

What makes certain areas healthy real estate markets? In an article published by Wallethub, economists looked at data from the top 300 Metropolitan areas in the United States. They compared data for real estate and employment and affordability rankings in each of the metros. Economists see that when the job market is holding steady, and unemployment rate is low, the housing market holds steady as well.

“To help prospective home buyers find the most attractive markets, WalletHub compared 300 U.S. cities across 14 key metrics. Our data set ranges from median home-price appreciation to home price as a percentage of income to job growth (WalletHub, 2015).”

That’s a pretty sophisticated study, right? For those familiar with The Bluegrass Region – Forbes and our Chamber of Commerce have designated our region as a great place to start a small business because of the strong economy and low unemployment rate. This still holds true as we see its effect on Lexington showing up in the Top 30% of this list! (See the Methodology of this study and a breakdown of the metrics that WalletHub analyzed [click here])

See the Full List of 300 Healthy Real Estate Markets by heading over to the full article on WalletHub.com – see the link in the source list down below!

Have questions about the market in your particular part of The Bluegrass? Wondering what the median prices and days are market are for your county? Your Neighborhood? Your Street? Get in touch with your Rector Hayden Agent today or contact clientcare@rhr.com to get individual assistance! Rector Hayden can research and present to you the most comprehensive detailed reports of the market in your area – whether you’re interested in all of The Bluegrass or two blocks east of the courthouse! With our leading technology and training, our agents are best prepared to help you in all real estate matters.

Source: WalletHub: 2015’s Healthiest Housing Markets. Richie Bernardo – https://wallethub.com/edu/healthiest-housing-markets/14889/

Unless you LOVE yard work, look for a starter home with a smaller outside space. Homeowner responsibilities can be a bit more than you may be used to, so don’t take on acres and acres of land if mowing and landscaping aren’t your strong suit (and you don’t want to spend a lot of money on care). Or, look for a home that is part of an affordable Home Owner’s Association that would take care of the outdoor work for you. Yard management is very important, especially if you still plan to do a lot of traveling [still returning home for the holiday seasons?].

Unless you LOVE yard work, look for a starter home with a smaller outside space. Homeowner responsibilities can be a bit more than you may be used to, so don’t take on acres and acres of land if mowing and landscaping aren’t your strong suit (and you don’t want to spend a lot of money on care). Or, look for a home that is part of an affordable Home Owner’s Association that would take care of the outdoor work for you. Yard management is very important, especially if you still plan to do a lot of traveling [still returning home for the holiday seasons?]. The golden rule of real estate: “Location, Location, Location” – Look for your new starter home in a good location. Close to your place of work, or convenience shopping & needs. Do you normally take public transportation? Look around for areas on bus routes. Or, do you like running in the park? Look for home options near your favorite places! And remember, you don’t have to look far away from the city to find your price range – especially if living far out doesn’t fit your lifestyle … bringing us to tip #3!

The golden rule of real estate: “Location, Location, Location” – Look for your new starter home in a good location. Close to your place of work, or convenience shopping & needs. Do you normally take public transportation? Look around for areas on bus routes. Or, do you like running in the park? Look for home options near your favorite places! And remember, you don’t have to look far away from the city to find your price range – especially if living far out doesn’t fit your lifestyle … bringing us to tip #3!

Remember, this is your starter home. Don’t get carried away just because you may qualify for a low down-payment or low monthly payments on your first mortgage. Choose a starter home that fits your needs and lifestyle within reason. Don’t overwhelm your finances on your first property. Your forever home / dream home come later in life.

Remember, this is your starter home. Don’t get carried away just because you may qualify for a low down-payment or low monthly payments on your first mortgage. Choose a starter home that fits your needs and lifestyle within reason. Don’t overwhelm your finances on your first property. Your forever home / dream home come later in life. Don’t get sucked in to the DIY Pinterest phase and think you can ‘total home makeover’ a property. If you know you aren’t handy, then don’t buy a fixer-upper. (Or, on the other hand – if you have a great contractor in your family, then buying a fixer-upper may be a great starter home project!). What may look like a great deal still needs to be inspected. Too many repairs can become quite costly and end up costing your much more.

Don’t get sucked in to the DIY Pinterest phase and think you can ‘total home makeover’ a property. If you know you aren’t handy, then don’t buy a fixer-upper. (Or, on the other hand – if you have a great contractor in your family, then buying a fixer-upper may be a great starter home project!). What may look like a great deal still needs to be inspected. Too many repairs can become quite costly and end up costing your much more.