This Veteran’s Day, Friday November 11th, 2016, restaurants, stores and other establishments all across the country and Central Kentucky are thanking our military.

***Most businesses require proof of military service, and the deals include participating locations only. It’s recommended you call specific locations to make sure they are taking part in the promotions.***

Restaurants:

Applebee’s: Veterans and Active Duty Military can select a free meal from a limited menu for Veteran’s Day. Provide proof of service required. All current and former military personnel will also receive a $5 coupon that can be redeemed between November 12 and November 27, 2016.

BJ’s Restaurant: All veterans and active military can enjoy a complimentary entree under $12.95 on Friday, 11/11/2016. Please present your military ID to receive this offer.

Bob Evans: free breakfast all day long on Veteran’s Day for veterans and active-duty military.

Buffalo Wild Wings: complimentary order of wings and a side of fries to veterans and active-duty military. Must present acceptable proof of military service, which includes: permanent or temporary U.S. military ID cards, veteran’s card, a photograph of yourself in military uniform, or dine-in at a participating location in uniform.

California Pizza Kitchen: free entrée from the Veterans’ Day menu. Please come in uniform or bring your military ID or other proof of service.

Chipotle: Friday, November 11th, from 3pm-close: a buy one, get one free burrito, bowl, salad, or taco order. Valid for all US military active-duty, Reserves, National Guard and retired military, military spouses with ID and veterans.

Central Kentucky Tours – Harrodsburg, KY: Each paying guest may bring an active member of the military or a veteran along for free. The Veterans Day bourbon distillery tour will include stops at Limestone Branch Distillery, Makers Mark Distillery, Wilderness Trail Distillery and Kentucky Cooperage.

Churchill Downs – Louisville, KY: On Nov. 11, Churchill Downs is offering free general admission tickets and discounted Millionaires Row tickets ($29, regularly $38) for all military personnel and veterans.

City Barbeque: One free sandwich platter will be given to each veteran for either dine-in or carryout orders. At participating locations only. Veterans Day only.

Cracker Barrel: offering military veterans a complimentary slice of its Double Chocolate Fudge Coca-Cola Cake. Must show proof of military service

Denny’s: active, inactive and retired military personnel will get a free Build Your Own Grand Slam on Friday, Nov. 11, from 5 a.m. to noon. Please show valid military id.

Golden Corral: Monday November 14, 5 p.m. – 9 p.m. is Military Appreciation night with a free “thank you” dinner. Must show proof of military service.

Hooters: all active-duty and retired military to stop in for a free meal from the Hooters Veterans Day Menu by presenting a military ID or proof of service at any Hooters location nationwide.

Hopcat – Lexington, KY [local]

On November 11, come to HopCat and receive a meal + soft drink on Hopcat.

IHOP: Vets and active-duty military: Red, White & Blue Pancakes free from 7 a.m.-7 p.m.

Johnny Carino’s: Vets eat free all day on Veterans Day from a special menu & to go is included. Indiana and Kentucky locations only.

Krispy Kreme Free Doughnut & Coffee: On Veterans Day 2016, a free doughnut and small coffee will be given to anyone who identifies themselves as a veteran or active military personnel (no ID required).

Logan’s Roadhouse: This Veterans Day veterans and active duty can come in for a free dessert a participating locations. Veterans year round receive a 10% discount to guests who present a military or veterans’ ID.

Longhorn Steakhouse: will offer a free appetizer or dessert (no purchase required, no restrictions) to anyone showing proof of military service, plus 10% off for guests that dine with Veterans on November 11.

O’Charley’s: O’Charley’s will honor our military on Veterans Day 2016 by offering veterans and active duty service members a free meal at any location on November 11th. Additionally, O’Charley’s offers a 10 percent military discount all year long.

Old Chicago Pizza & Taproom

Participating locations will offer a complimentary craft beer to active and retired military personnel.

The Old Owl Tavern at Beaumont Inn – Harrodsburg, KY [LOCAL]

Active military or veterans can enjoy a free meal (alcohol excluded) with the purchase of a meal by an accompanying guest.

Olive Garden: will offer a free entrée from a special menu to active-duty military and military veterans.

Outback Steakhouse Free Bloomin’ Onion® and a beverage: All active, retired military and veterans get a free Bloomin’ Onion® and a beverage on Veterans Day. Must have valid identification. There is also a military discount of 15% off the total check from valid for military members and their families.

Panera Bread: a complimentary You-Pick-Two with military identification or if wearing their uniform to the participating Panera Bread bakery-cafes in the Cleveland, Akron, Canton area. For a complete list of participating bakery-cafes, click here.

Red Lobster: To thank Veterans, active duty military and reservists, Red Lobster will offer a free appetizer or dessert from their select Veterans Day menu. To receive offer, show a valid military ID on November 10th and 11th.

Red Robin: all Veterans and active-duty military members will get a free Red’s Tavern Double Burger and Bottomless Steak Fries. No purchase is necessary. Just show proof of service.

Ruby Tuesday: On 11/11/2016 veterans, active duty, and reservists (with proof of service) may receive one free appetizer up to $10 in value.

Starbucks: On Veterans Day 2016, active duty service members, reservists, veterans and military spouses are invited to enjoy a free Tall Brewed Coffee. In addition, now through November 11, for every Veterans Day Starbucks Card or eGift purchased, Starbucks will contribute $5 to help support programs assisting service members, military spouses and veterans.

TGI Fridays Free Lunch: Guests who show valid military ID can enjoy a free lunch menu item up to $12. This offer is valid on Friday, November 11th, from 11 a.m. to 2 p.m. local time.

Retailers/services:

Gordman’s: offering all active-duty, Reserves, Guard, retirees and Veterans a $10 Gordmans Savings Card with any in-store purchase on Veterans Day. In addition, they will receive 15% off their entire purchase. Must show military ID or shop in uniform.

Great Clips: Customers who come in Nov. 11 for a service can get a free haircut card to give to their favorite veteran. Veterans can also get a free haircut or get the free haircut card. Haircuts are redeemable until Dec. 31.

JCPenney: will offer a 5 percent discount from Nov. 10-13 to current and former military personnel and their immediate family members with valid military or VA identification provided in-store. The discount may be combined with additional coupons and special offers including a $10 off $25 coupon with any form of payment or 20 percent off coupon when paying with a JCPenney credit card.

For more information about this list visit: http://militarybenefits.info/local-area-veterans-day-deals-for-veterans

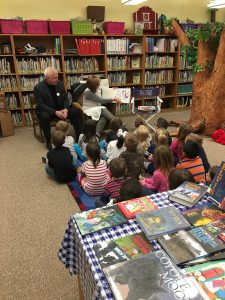

Rector Hayden REALTORS is so blessed to have many other agents participate in this event.

Rector Hayden REALTORS is so blessed to have many other agents participate in this event.